Scale your clean energy transition Projects & Investment Opportunities in India

Saime originates, structures and delivers bankable renewable projects — solar, hybrid and storage — across India. We partner with utilities, corporates and investors to unlock predictable clean power and attractive long-term returns.

Why India — Why Now

India’s energy transition presents one of the world’s largest opportunities for clean power deployment. With ambitious national targets for renewable capacity, improving grid access and increasing corporate demand for decarbonisation, there is strong momentum for utility-scale and distributed projects. Saime focuses on bankable projects and flexible offtake structures that match this market opportunity — making it practical for investors and corporate buyers to move to 100% clean energy.

India’s Renewable Energy Growth Story

Robust Demand

*Ambitious Targets: India aims for 500 GW of non-fossil electricity by 2030, as committed by the Prime Minister at COP26. In 2023 alone, 13.5 GW of renewable capacity was added, backed by ₹74,000 crore (US$ 8.9 billion) investment.

*Future Power Needs: A national plan worth ₹9.22 lakh crore (US$ 109.5 billion) is underway to meet projected demand of 458 GW by 2032 — focusing on transmission upgrades, renewable integration, and energy security.

*Record Growth: Renewable capacity addition surged 420% YoY in June 2025, climbing from 1.4 GW (2024) to 7.3 GW this year.

Increasing Investments

*Corporate Commitments: Indian conglomerates have announced ₹67.4 lakh crore (US$ 800 billion) investment in green hydrogen, clean energy, semiconductors, and EVs by 2034.

*Foreign Capital: In 2023, India attracted ₹42,000 crore (US$ 4.88 billion) in clean energy FDI. Since 2020, total inflows have crossed ₹1.6 lakh crore (US$ 18.6 billion).

*Q1 2025 Momentum: Clean energy investments skyrocketed 7.7x YoY to ₹84,309 crore (US$ 9.8 billion).

Policy Support

*State-Level Push: Rajasthan signed an MoU with NTPC Green Energy (Sept 2024) for 28,500 MW of projects, part of 31,825 MW total capacity worth ₹1.6 lakh crore (US$ 19.18 billion). This positions Rajasthan as a renewable powerhouse.

*New Projects: In Aug 2025, Hindustan Power inked a 25-year PPA with Uttar Pradesh Power Corporation Ltd. to supply clean power from a 435 MW DC solar project, aligning with UP’s goal of 22,000 MW clean energy by 2026-27.

Competitive Advantage

*Global Standing: India ranks #4 worldwide in wind, solar, and total renewable energy capacity as of FY25 — holding steady from FY24.

*Cost Competitiveness: Between 2025–2030, solar and wind are projected to remain cheaper than thermal power, accelerating adoption.

*Solar Leadership: India has overtaken Japan to become the world’s #3 solar producer, generating 1,08,494 GWh, ahead of Japan’s 96,459 GWh (IRENA data).

Our Energy Transition Solutions

Representative projects developed and managed by Saime — engineered for maximum yield and reliability.

Solar Power

What it is: Large-scale photovoltaic (PV) plants that convert sunlight into electricity using proven, bankable solar modules and inverter systems.

Benefits:

Low-cost renewable energy with steadily declining tariffs

Quick deployment timelines (6–18 months)

Modular and scalable for projects from rooftops to gigawatt-scale parks

Long-term predictable returns under PPAs

Ideal for: Utilities, government tenders, industrial consumers with daytime loads, and corporates seeking cost-competitive green power.

Wind Power

What it is: Utility-scale wind turbines harnessing high wind corridors to deliver renewable electricity, often complementary to solar generation patterns.

Benefits:

Strong night-time and seasonal generation complementing solar

Competitive tariffs with proven technology

Large capacity installations supported by robust policy mechanisms

Low land-use intensity compared to solar

Ideal for: State utilities, independent power producers (IPPs), industrial parks, and open-access buyers in wind-rich regions.

Waste-to-Energy (WtE)

What it is: Advanced processing of municipal solid waste (MSW) and industrial waste into usable energy (electricity, BioCNG, RDF, and by-products like Plasmarok®). Saime leverages GasPlasma® and other proven technologies adapted for Indian waste streams.

Benefits:

Converts unsegregated waste into valuable energy and fuels

Reduces landfill dependency and methane emissions

Creates multiple revenue streams (power sales, BioCNG, recyclables, construction aggregates)

Supports circular economy and ESG impact goals

Ideal for: Municipal corporations, state governments, industrial clusters, large urban utilities, and investors seeking dual returns — financial performance + environmental impact.

Discover Our Vision & Impact in Action

Watch how we turn waste, solar and wind resources into scalable, bankable clean-energy assets — and explore how you can partner in our upcoming projects.

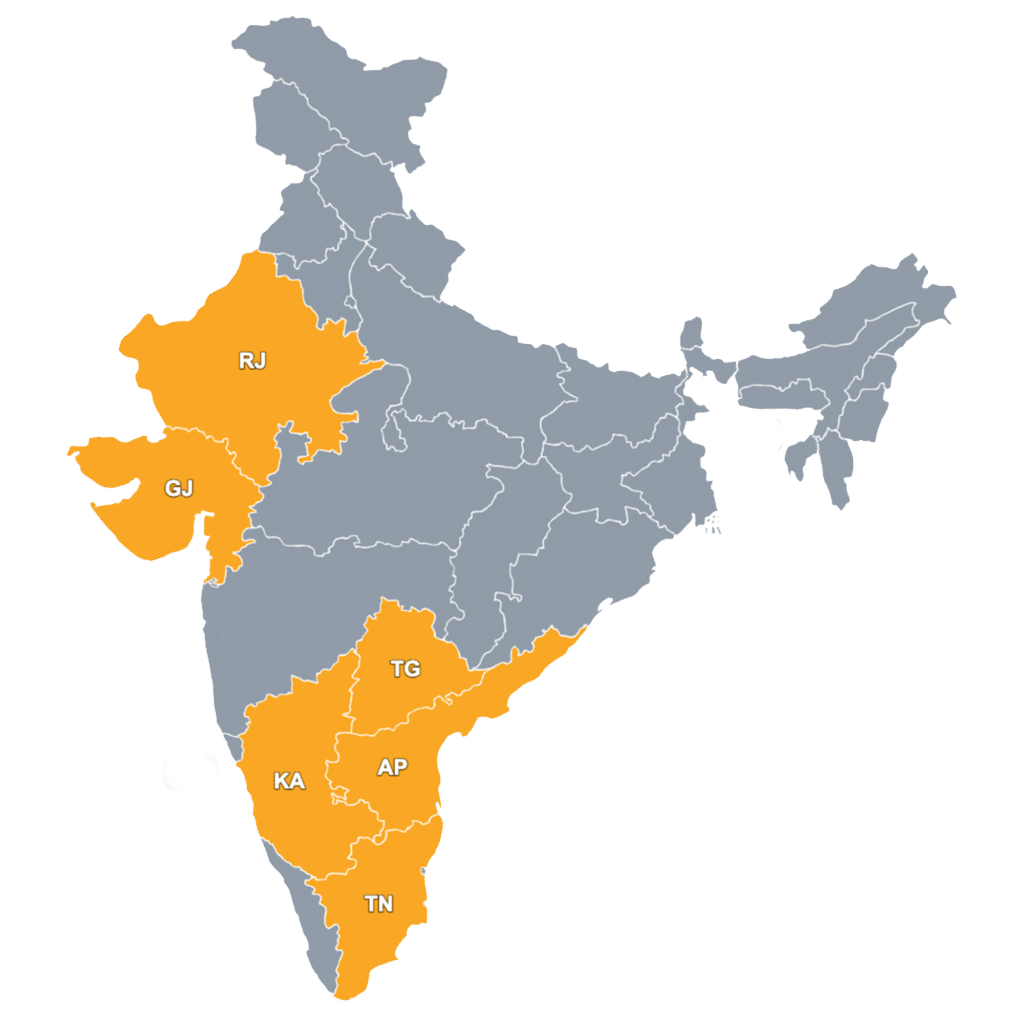

Where We Operate — Renewable Hubs

Saime prioritises regions and hubs with strong solar/wind resources, grid access and open-access potential. Key states include Gujarat, Karnataka, Rajasthan, Andhra Pradesh and Tamil Nadu — each offering strategic advantages for utility and corporate projects. (A detailed interactive map and hub analysis is available in the investor pack.)

Renewable Energy Hubs

- Rajasthan

- Gujarat

- Andhra Pradesh

- Karnataka

- Telangana

- Tamil Nadu

Who Benefits

Utilities & DISCOMs

Cost-competitive, long-term supply and grid stability options.

Corporate & Industrial Buyers

Tailored RTC and open-access solutions to meet sustainability targets.

I-RECs & Green Attributes

Verified renewable energy certificates that provide internationally recognized proof of clean power consumption.

Communities & Government

Local jobs, infrastructure improvements and emissions reductions.

Investors & Partners

Bankable assets, structured returns and portfolio diversification into India’s energy transition.

Investment Opportunities

Saime’s portfolio approach allows multiple entry points for investors and partners

- Project equity in SPVs (co-development/JV models).

- Buy-and-hold operational assets with contracted revenues.

- Structured offtake contracts (corporate PPAs / virtual PPAs).

- Greenfield development participation (early stage, higher IRR).

FAQs

1. Can Saime structure virtual PPAs or open-access contracts?

Yes — we design both physical and virtual offtake arrangements to suit buyer needs and regulatory constraints.

2. Is battery storage required?

Not always. Storage is recommended where dispatchability, peak shifting or RTC guarantees are needed.

3. What scales can you deliver?

From single-site corporate projects of a few MW to utility-scale plants of tens to hundreds of MW via grouped SPVs.

4. How do I get the financial model?

Request the project brief and sign the NDA to access financials and the data room.